The Rise of Robinhood

By Megan Delaney on Sep 23, 2020

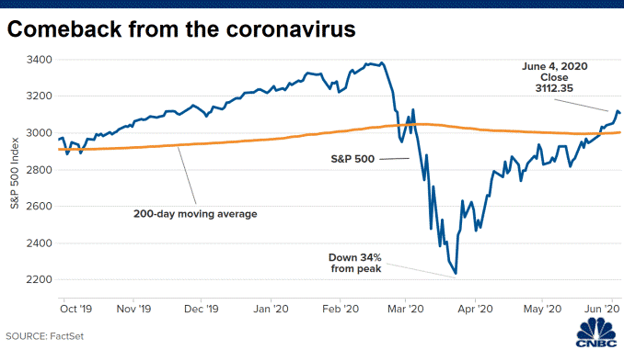

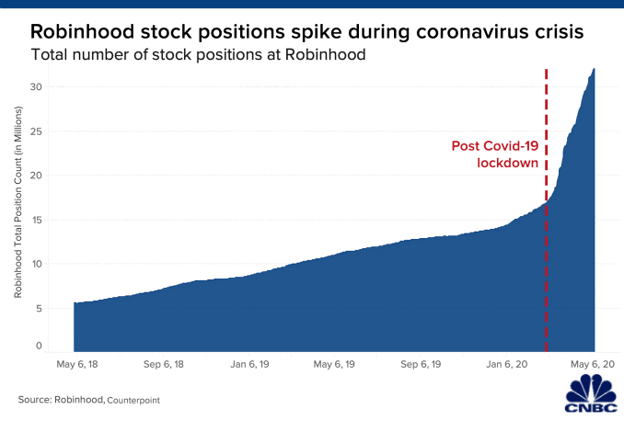

There have been many investment apps that have come out over the past few years but none have achieved quite the notoriety of Robinhood in the wake of COVID-19. While many investors sat on the sidelines during the coronavirus downturn, millennials saw an opportunity. Aided by zero commissions and fractional trades, some major online brokers like Charles Schwab, TD Ameritrade, Etrade and Robinhood saw new accounts grow as much as 170% in the first quarter. Young investors took the opportunity to buy technology stocks they were already familiar with, driving the rebound led by tech stocks in March.

Robinhood, in particular, saw 3 million new accounts in the first quarter, driven categorically by millennials. With increased time on their hands, lack of sports betting/gambling and new lows in the market, millennials capitalized on the dip. Robinhood’s investors were buying the most beaten down stocks like airlines, casinos and hotels at the same time billionaire investors like Warren Buffett were selling. Airlines, videoconferencing, streaming services and pharmaceuticals have been trading heavily on Robinhood in the past few months.

Robinhood is capitalizing on this generation’s tech savviness and making investing accessible to Millennials and Gen Z with an app that’s available at their fingertips. As of this writing, Robinhood was worth more than $11 billion…which is even more than traditional gambling companies MGM and Wynn. Yet with their success has also come difficulties. Over the first half of 2020, over 400 complaints about Robinhood were received.

Chief among these complaints was when Robinhood stopped working for more than a day in early March, when markets were swinging wildly due to coronavirus fears. Some complainants couldn’t sell holdings, subsequently losing thousands of dollars, while others were upset they missed out on the opportunity to profit. While all of this was happening, no one could get in touch with Robinhood for assistance, as they did not have a phone number listed online. Both the SEC and FINRA are currently investigating Robinhood for their handling of this outage. Furthermore, a 20-year-old college student committed suicide after his Robinhood account showed a negative balance of over $700,000. The student had been selling options and may have misunderstood the financial statements. Robinhood has since made changes to its platform, including making it harder to access options trading.

Robinhood is appealing to younger investors due to its easy-to-use interface and low barriers to entry. They don’t need a ton of money to get started and they can trade with one click. While Robinhood is taking away some traditional obstacles for investors, users should know the risks and do their research before investing in stocks.

Sources:

Robinhood Rise Brings Setbacks of Irate Traders, U.S. Probes

10 Robinhood Stocks Investors Are Buying in August

Robinhood Review 2020: Pros, Cons & How It Compares

Robinhood traders cash in on the market comeback that billionaire investors missed

Young investors pile into stocks, seeing ‘generational-buying moment’ instead of risk

Millennials are the biggest — but poorest — generation

Before investing you should carefully consider the Fund’s investment objectives, risks, charges and expenses. This and other information are in the prospectus, a copy of which may be obtained by visiting the Fund’s website (overlayshares.com). Please read the prospectus carefully before you invest.

Foreside Fund Services, LLC, distributor.

Investments involve risk including the possible loss of principal. The Funds were recently organized and as a result, it has a limited track record on which to base an investment decision upon. The Funds invest in short term put options that derive their performance from the performance of the S&P 500 Index. Selling (writing) and buying options are speculative activities and entail greater than ordinary investment risks. The Funds could experience a loss or increased volatility in highly volatile market conditions or if the Funds are unable to purchase or liquidate a position to offset their costs or the amount of premium.

- March 2026 (1)

- January 2026 (4)

- October 2025 (3)

- August 2025 (1)

- July 2025 (3)

- May 2025 (1)

- April 2025 (7)

- March 2025 (2)

- February 2025 (1)

- January 2025 (1)

- November 2024 (1)

- October 2024 (1)

- July 2024 (2)

- April 2024 (1)

- January 2024 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (1)

- April 2023 (1)

- January 2023 (1)

- November 2022 (1)

- October 2022 (2)

- July 2022 (1)

- April 2022 (1)

- March 2022 (2)

- February 2022 (3)

- January 2022 (3)

- November 2021 (1)

- October 2021 (3)

- September 2021 (1)

- July 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (3)

- January 2021 (3)

- December 2020 (3)

- October 2020 (3)

- September 2020 (2)

- August 2020 (4)

- July 2020 (6)

- June 2020 (4)

- May 2020 (4)

- April 2020 (4)

- March 2020 (14)

- February 2020 (9)

- January 2020 (3)

- December 2019 (1)

- November 2019 (1)

- October 2019 (1)

- July 2019 (1)

- April 2019 (1)

Subscribe

You May Also Like

These Related Posts

Seriously, Get a Dog

Find the Time