In my role, the first thing everyone wants to talk about is my opinion on the markets (and ideally exactly what to buy and sell and when!). These advice seekers usually walk away empty handed in terms of specific investment ideas, but I am always happy to talk big picture in terms of broad risks and opportunities. The only question that I have gotten over the past few weeks is some version of: “Why is there such a big disconnect between the stock market and the economy…shouldn’t the market be much lower?”

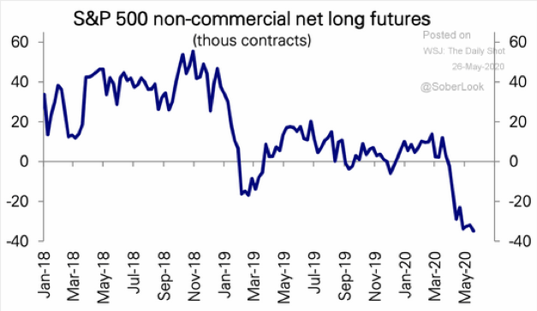

Even experts that got bullish near market lows now express skepticism about the magnitude of the recovery. Even after a nearly 40% rally in the S&P 500 Index from the March intra-day low, this bearish sentiment is pervasive in many corners of the investing community from large institutional investors with big names and reputations to individual investors across the country. The following chart illustrates the significant increase in net short positions since the market bottom as large investors made bets that the rally would end.

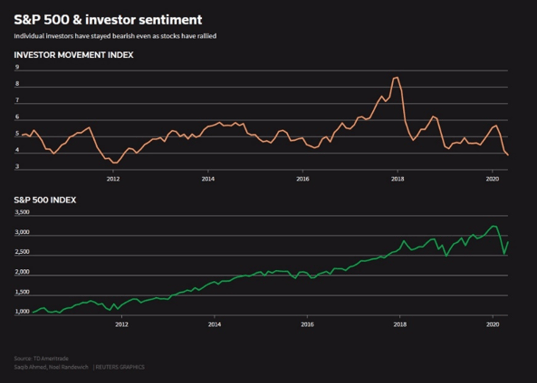

On the individual side, TD Ameritrade tracks the sentiment of its customers based on their activity in what they call the Investor Movement Index. As the chart below shows, the current sentiment is at the lowest level since 2012.

The equity markets have clearly been climbing one of the biggest and steepest walls of worry ever. While it is possible to lay out solid cases for various glide paths for the market over the next 6-12 months, one key variable to watch for is the impact that this bearish sentiment could have if these investors finally relent and begin to put money into the stock market again. A shift to more bullish sentiment could have a dramatic impact on the equity markets.

Learn more about Liquid Strategies and our offerings.

The assertions and statements in this blog post are based on the opinions of the author and Liquid Strategies. The examples cited in this paper are based on hypothetical situations and should only be considered as examples of potential trading strategies. They do not take into consideration the impact that certain economic or market factors have on the decision making process. Past performance is no indication of future results. Inherent in any investment is the potential for loss.