If there’s one thing we can all agree on in the age of coronavirus, it’s that we cannot stay shut down forever. Sooner or later we will have to reopen, and many states have already started that process with mixed results. People want to feel safe as they come out of isolation and venture back into the world, and even with social distancing, masks and testing, many of us will not truly feel safe until a vaccine is developed.

Several companies are in the process of developing a vaccine, with one from Moderna moving into Phase II trials this month with hopes of beginning Phase III trials in July. While the first trial consisted of 45 volunteers, Phase II will consist of an additional 600 volunteers. While certainly encouraging, it is still very early in the process and only 8 volunteers have developed neutralizing antibodies so far. With Phase I trials so limited in scope, does that speak to the desire/insanity (at any cost) of investors to find some snippet to keep this run-up going?

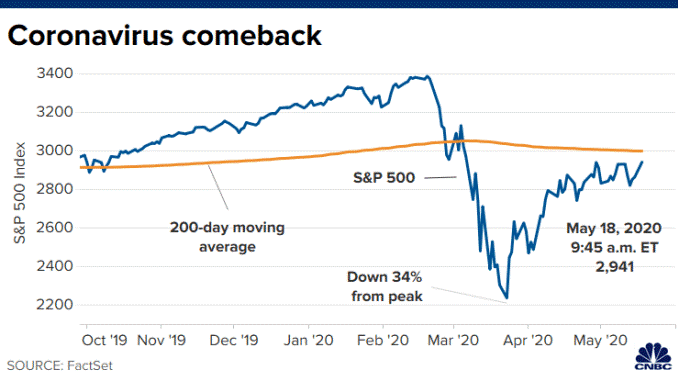

News of a potential vaccine is not only good for humanity, it’s also good news for the stock market. The market was trending up at the beginning of the week of May 18th at the news of the successful Moderna trial. With every new piece of information we learn about COVID-19, the closer we get to a new normal. Currently there are dozens of companies working towards creating a vaccine, some with positive results.

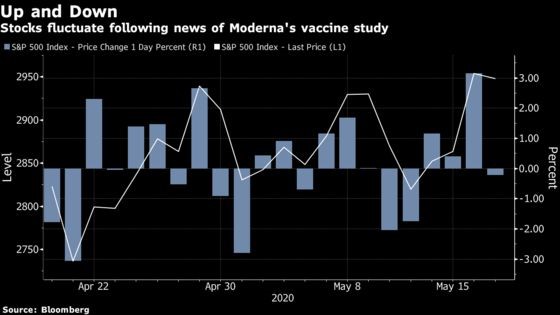

As we navigate this pandemic, volatility in the market is expected. After opening strong on Monday, May 18th with the news of a potential vaccine from Moderna, the very next day the S&P 500 turned negative in the last hour of trading due to news of doubt about the vaccine study. Moderna’s vaccine study did not yield enough critical data to truly assess the success of the trial. The expectation is this type of fluctuation will continue as more information becomes available and until a vaccine is developed.

Sources:

https://www.bloombergquint.com/markets/asia-stocks-to-advance-after-u-s-rally-oil-gains-markets-wrap

Learn more about Liquid Strategies and our offerings.

The assertions and statements in this blog post are based on the opinions of the author and Liquid Strategies. The examples cited in this paper are based on hypothetical situations and should only be considered as examples of potential trading strategies. They do not take into consideration the impact that certain economic or market factors have on the decision making process. Past performance is no indication of future results. Inherent in any investment is the potential for loss.