The Role of Bonds in Today’s Portfolio

By Justin Boller on Aug 04, 2020

The traditional role of bonds in a diversified portfolio has changed. Historically, bonds served a dual role of providing steady income while also offsetting the volatility that comes from owning stocks. With the Federal Reserve holding interest rates near 0% for the foreseeable future, the income story has almost completely evaporated. With income off the table, is it prudent to still own bonds?

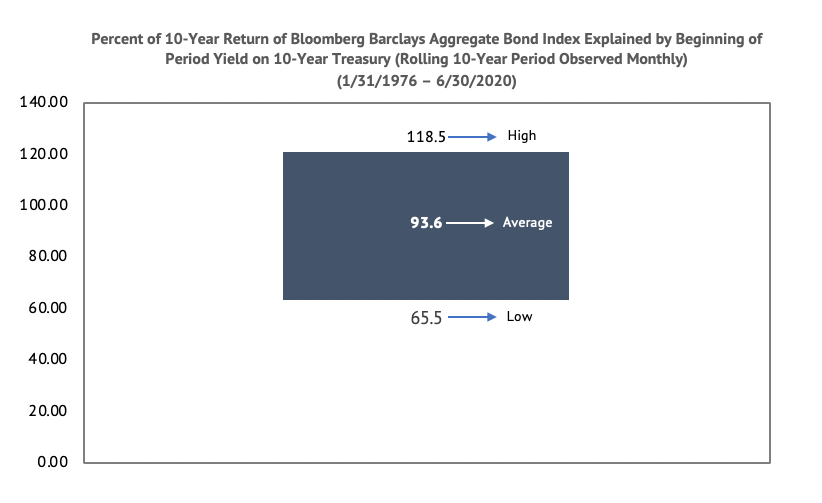

The first question to ask is what to expect out of investment grade bonds going forward. History tells us that one of the best predictors of long-term bond returns is the current yield. In fact, the prevailing yield on the 10 year Treasury has accounted for over 90% of the next 10 year annualized return of the Bloomberg Barclays US Aggregate Bond Index (the industry standard index for investment grade bonds).

As of this writing, the current yield on the 10 Year Treasury is 0.53%. Applying the historic ranges, we might expect investment grade bonds to deliver an annualized return between 0.45% and 0.82% with an average of 0.57%. Once advisory fees are factored in, not to mention inflation, an allocation to traditional investment grade bonds suddenly moves from being low returning portfolio “ballast” to a high probability of being value destroying “ballast”.

The challenge for today’s investors will be finding a way to maintain the attractive properties of investment grade bonds that provide ballast to a stock portfolio, while still being value added to the bottom line of the portfolio. Simply looking at bonds the way we used to is not going to suffice.

Our firm believes that bonds can still play a meaningful role in nearly all portfolios, but need a little help to make them viable from an income and return standpoint. Attaching a modest incremental income stream can elevate the return potential of this segment of a portfolio without sacrificing the desired properties that make it a good offset to stocks.

Learn more about Liquid Strategies and our offerings.

The assertions and statements in this blog post are based on the opinions of the author and Liquid Strategies. The examples cited in this paper are based on hypothetical situations and should only be considered as examples of potential trading strategies. They do not take into consideration the impact that certain economic or market factors have on the decision making process. Past performance is no indication of future results. Inherent in any investment is the potential for loss.

- January 2026 (4)

- October 2025 (3)

- August 2025 (1)

- July 2025 (3)

- May 2025 (1)

- April 2025 (7)

- March 2025 (2)

- February 2025 (1)

- January 2025 (1)

- November 2024 (1)

- October 2024 (1)

- July 2024 (2)

- April 2024 (1)

- January 2024 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (1)

- April 2023 (1)

- January 2023 (1)

- November 2022 (1)

- October 2022 (2)

- July 2022 (1)

- April 2022 (1)

- March 2022 (2)

- February 2022 (3)

- January 2022 (3)

- November 2021 (1)

- October 2021 (3)

- September 2021 (1)

- July 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (3)

- January 2021 (3)

- December 2020 (3)

- October 2020 (3)

- September 2020 (2)

- August 2020 (4)

- July 2020 (6)

- June 2020 (4)

- May 2020 (4)

- April 2020 (4)

- March 2020 (14)

- February 2020 (9)

- January 2020 (3)

- December 2019 (1)

- November 2019 (1)

- October 2019 (1)

- July 2019 (1)

- April 2019 (1)

Subscribe

You May Also Like

These Related Posts

Find the Time

OVB Crosses $100 Million in Assets