Stay in the Game

By Tom Contrucci on Mar 08, 2022

“It’s difficult to make predictions, especially about the future.” - Mark Twain

The start of 2022 has been difficult in the financial markets to say the least. Asset returns have been challenging so far with equity and fixed income asset classes in negative territory year to date. Headlines across the board are a seemingly endless stream of bad news from inflation, anticipated interest rate hikes, and geopolitical uncertainty.

So, what is an investor to do in difficult times like we are experiencing now? The answer…stay invested in strategies that compound gains over time and don’t risk missing the market's best days.

A recent study of the S&P 500* highlights the impact on returns for a $10,000 investment that missed the 5, 10, 30 and 50 best days since 1980 (over 10,000 trading days).

-

- Staying invested all days resulted in a gain of $697,421

- Missing the 5 best days resulted in a gain of $432,411, equating to missed growth of $265,010 or 38% less

- Missing the 10 best days resulted in a gain of $313,377, equating to missed growth of $384,044 or 55% less

- The results for missing the best 30 and 50 days are even worse with 83% and 93% less growth

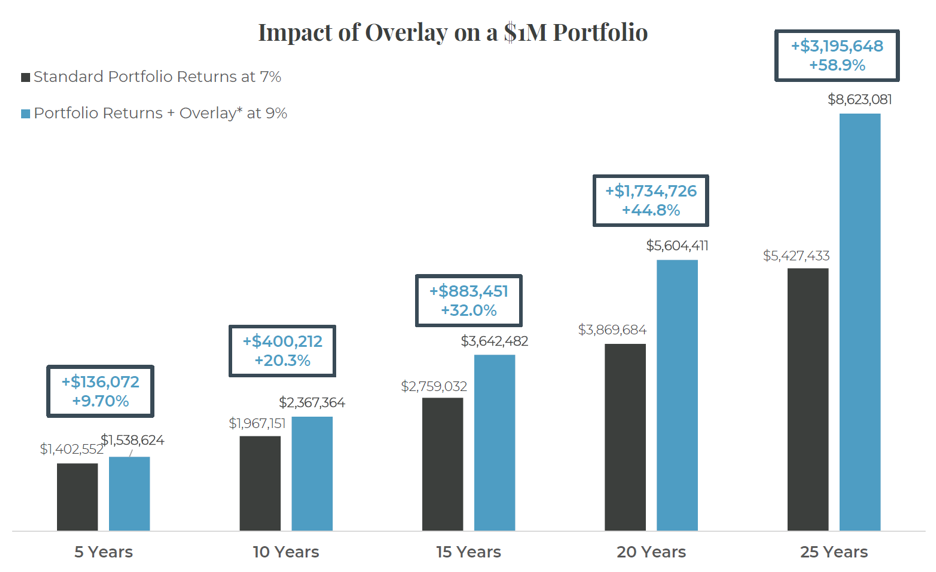

Time in the market is much more important than timing the market. Long term investors appreciate this and embrace the concept of compounding over time. At Overlay Shares we actively work with advisors and investors to deliver strategies that enable long term compounding from a conservative investment approach. Our equity and fixed income ETF strategies have the potential to add an additional 2.0% of tax efficient income on top of their respective underlying assets.

The Power of Compounding: An Additional 2.0%**

**Assumes a 2.0% net annualized Overlay return

Allocating to strategies that actively incorporate the benefits of compounding can help keep investors on track to achieve their desired outcomes, particularly during times of market stress.

*Source for S&P 500 Study, Fidelity Investments Research

Learn more about Liquid Strategies and our offerings.

The assertions and statements in this blog post are based on the opinions of the author and Liquid Strategies. The examples cited in this paper are based on hypothetical situations and should only be considered as examples of potential trading strategies. They do not take into consideration the impact that certain economic or market factors have on the decision making process. Past performance is no indication of future results. Inherent in any investment is the potential for loss.

- March 2026 (1)

- January 2026 (4)

- October 2025 (3)

- August 2025 (1)

- July 2025 (3)

- May 2025 (1)

- April 2025 (7)

- March 2025 (2)

- February 2025 (1)

- January 2025 (1)

- November 2024 (1)

- October 2024 (1)

- July 2024 (2)

- April 2024 (1)

- January 2024 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (1)

- April 2023 (1)

- January 2023 (1)

- November 2022 (1)

- October 2022 (2)

- July 2022 (1)

- April 2022 (1)

- March 2022 (2)

- February 2022 (3)

- January 2022 (3)

- November 2021 (1)

- October 2021 (3)

- September 2021 (1)

- July 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (3)

- January 2021 (3)

- December 2020 (3)

- October 2020 (3)

- September 2020 (2)

- August 2020 (4)

- July 2020 (6)

- June 2020 (4)

- May 2020 (4)

- April 2020 (4)

- March 2020 (14)

- February 2020 (9)

- January 2020 (3)

- December 2019 (1)

- November 2019 (1)

- October 2019 (1)

- July 2019 (1)

- April 2019 (1)

Subscribe

You May Also Like

These Related Posts

'We're at a pretty big inflection point' ahead of FOMC minutes, Jackson hole

Markets largely shrug off Trump impeachment