Put Writing as an Income Overlay

By Shawn Gibson on Feb 04, 2020

In a previous blog post (What is an Overlay?), we discussed how investors who utilize overlays do so with the goal of reshaping the potential investment outcomes with the most common goals being:

- Generating supplemental income/return (typically through covered call or put writing strategies

- Reducing the risk of the existing portfolio beta exposure (typically through collar strategies)

For investors seeking additional income, it is our belief that the best way to achieve this outcome is through a disciplined put spread writing program that provides investors with a relatively conservative stream of income that supplements the income/total return of the assets in the underlying.

Some investors look to covered call writing to solve the income dilemma. However, call writing offers potential drawbacks relative to a put writing program. First, a put writing overlay gives investors the opportunity to earn positive cash flow in a variety of markets without limiting the appreciation potential of the underlying assets. Call writing, on the other hand, limits the appreciation potential of the underlying assets which can offset any potential benefits of income received when the calls are written (call writing programs have a high risk of reducing the total return of a portfolio in a rising equity market). Second, below market put options offer significantly higher income potential relative to above market calls due to supply/demand pressures and other option pricing factors. This higher income gives investors a greater probability of success and allows them to better capture the volatility risk premium in the market.

While covered call writing may still address the needs of some investors, for those seeking to increase the return potential of a portfolio through an overlay should evaluate whether the overlay can truly add positive cash flow over time or if there is a risk of negative cash flow due to lost appreciation exceeding income generation.

Learn more about Liquid Strategies and our offerings.

The assertions and statements in this blog post are based on the opinions of the author and Liquid Strategies. The examples cited in this paper are based on hypothetical situations and should only be considered as examples of potential trading strategies. They do not take into consideration the impact that certain economic or market factors have on the decision making process. Past performance is no indication of future results. Inherent in any investment is the potential for loss. Options involve risk and are not suitable for all investors. Please see the following options disclosure document (ODD) for more information on the characteristics and risks of exchange traded options.

- March 2026 (1)

- January 2026 (4)

- October 2025 (3)

- August 2025 (1)

- July 2025 (3)

- May 2025 (1)

- April 2025 (7)

- March 2025 (2)

- February 2025 (1)

- January 2025 (1)

- November 2024 (1)

- October 2024 (1)

- July 2024 (2)

- April 2024 (1)

- January 2024 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (1)

- April 2023 (1)

- January 2023 (1)

- November 2022 (1)

- October 2022 (2)

- July 2022 (1)

- April 2022 (1)

- March 2022 (2)

- February 2022 (3)

- January 2022 (3)

- November 2021 (1)

- October 2021 (3)

- September 2021 (1)

- July 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (3)

- January 2021 (3)

- December 2020 (3)

- October 2020 (3)

- September 2020 (2)

- August 2020 (4)

- July 2020 (6)

- June 2020 (4)

- May 2020 (4)

- April 2020 (4)

- March 2020 (14)

- February 2020 (9)

- January 2020 (3)

- December 2019 (1)

- November 2019 (1)

- October 2019 (1)

- July 2019 (1)

- April 2019 (1)

Subscribe

You May Also Like

These Related Posts

What is an Overlay?

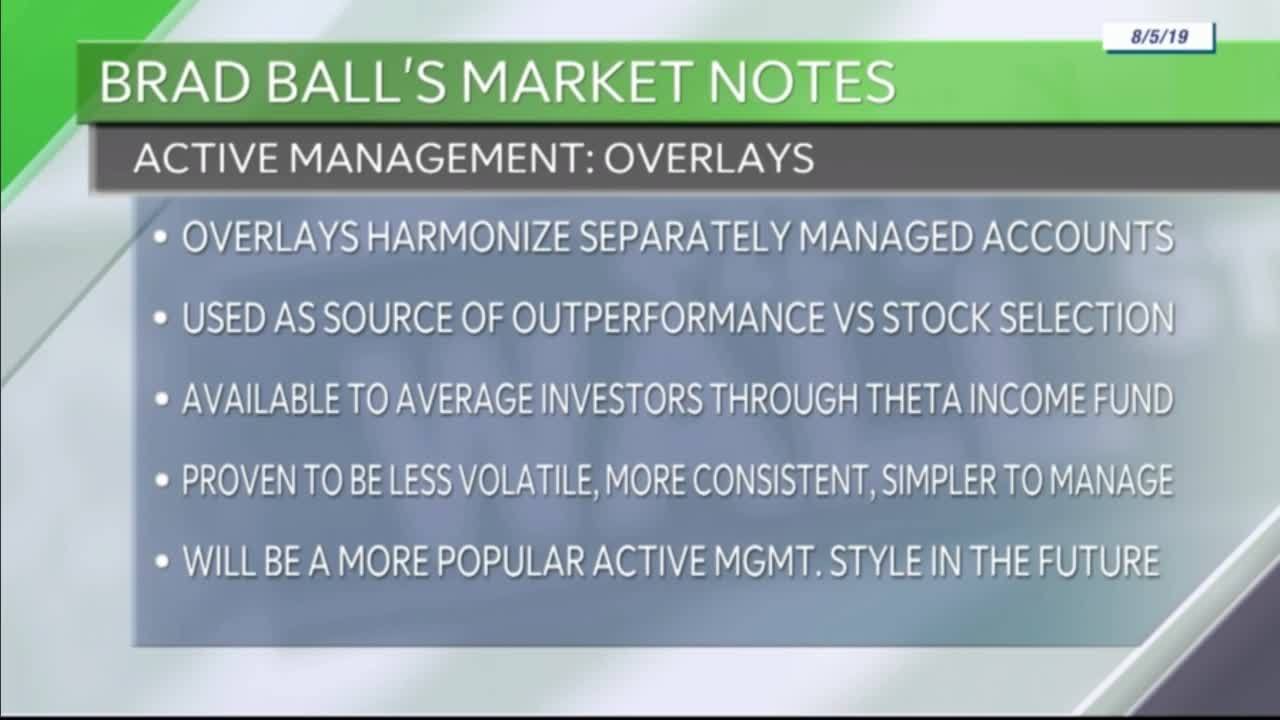

Brad Ball On Using Overlays As The Source Of Outperformance Vs Stock Selection