Is this the most hated rally ever?

By Shawn Gibson on Jun 02, 2020

In my role, the first thing everyone wants to talk about is my opinion on the markets (and ideally exactly what to buy and sell and when!). These advice seekers usually walk away empty handed in terms of specific investment ideas, but I am always happy to talk big picture in terms of broad risks and opportunities. The only question that I have gotten over the past few weeks is some version of: “Why is there such a big disconnect between the stock market and the economy…shouldn’t the market be much lower?”

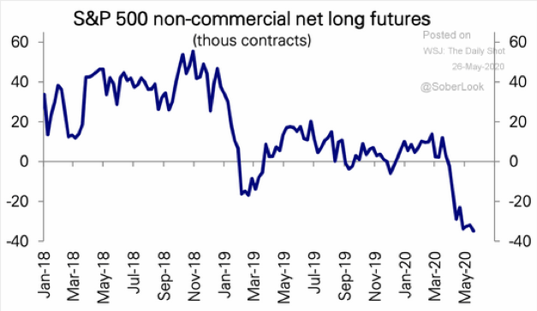

Even experts that got bullish near market lows now express skepticism about the magnitude of the recovery. Even after a nearly 40% rally in the S&P 500 Index from the March intra-day low, this bearish sentiment is pervasive in many corners of the investing community from large institutional investors with big names and reputations to individual investors across the country. The following chart illustrates the significant increase in net short positions since the market bottom as large investors made bets that the rally would end.

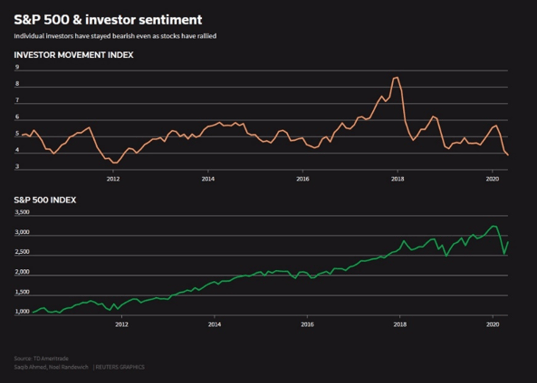

On the individual side, TD Ameritrade tracks the sentiment of its customers based on their activity in what they call the Investor Movement Index. As the chart below shows, the current sentiment is at the lowest level since 2012.

The equity markets have clearly been climbing one of the biggest and steepest walls of worry ever. While it is possible to lay out solid cases for various glide paths for the market over the next 6-12 months, one key variable to watch for is the impact that this bearish sentiment could have if these investors finally relent and begin to put money into the stock market again. A shift to more bullish sentiment could have a dramatic impact on the equity markets.

Learn more about Liquid Strategies and our offerings.

The assertions and statements in this blog post are based on the opinions of the author and Liquid Strategies. The examples cited in this paper are based on hypothetical situations and should only be considered as examples of potential trading strategies. They do not take into consideration the impact that certain economic or market factors have on the decision making process. Past performance is no indication of future results. Inherent in any investment is the potential for loss.

- January 2026 (4)

- October 2025 (3)

- August 2025 (1)

- July 2025 (3)

- May 2025 (1)

- April 2025 (7)

- March 2025 (2)

- February 2025 (1)

- January 2025 (1)

- November 2024 (1)

- October 2024 (1)

- July 2024 (2)

- April 2024 (1)

- January 2024 (1)

- November 2023 (1)

- October 2023 (1)

- August 2023 (1)

- July 2023 (1)

- April 2023 (1)

- January 2023 (1)

- November 2022 (1)

- October 2022 (2)

- July 2022 (1)

- April 2022 (1)

- March 2022 (2)

- February 2022 (3)

- January 2022 (3)

- November 2021 (1)

- October 2021 (3)

- September 2021 (1)

- July 2021 (1)

- May 2021 (1)

- April 2021 (1)

- March 2021 (3)

- January 2021 (3)

- December 2020 (3)

- October 2020 (3)

- September 2020 (2)

- August 2020 (4)

- July 2020 (6)

- June 2020 (4)

- May 2020 (4)

- April 2020 (4)

- March 2020 (14)

- February 2020 (9)

- January 2020 (3)

- December 2019 (1)

- November 2019 (1)

- October 2019 (1)

- July 2019 (1)

- April 2019 (1)

Subscribe

You May Also Like

These Related Posts

Wall Street closely watching the Fed, earnings, jobs report

Seriously, Get a Dog